The Impact of Habits Formed Over the Pandemic

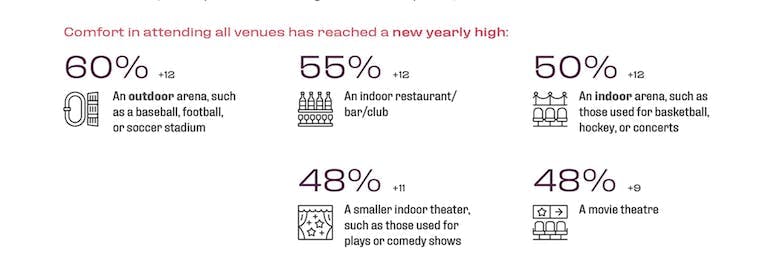

It is undoubtedly nice to see so many restaurants, bars and other businesses opening back up. More so, it is especially exciting to see (and hear) fans back at concerts and sporting events. According to a recent poll run by Big Village CARAVAN team, the comfort level of attending venues such as outdoor arenas, indoor restaurants, and theaters has reached an all-time high.

This certainly suggests that we are getting more and more comfortable with the idea of the country returning to a state of “normalcy”. As much of the country starts to reopen, I continue to think about the lasting impact the pandemic could or will have on all of us and specifically:

- How did the pandemic alter our everyday habits and routines (if at all)?

- Ultimately, how will these changes affect the way we shop and consume products?

Much of the article will cover habits altered within the financial services industry and more specifically auto insurance purchase and usage behaviors.

The pandemic unquestionably changed my routines over the past year, and I am certain that is the same for so many others, but are we set to go back to pre-pandemic habits and routines? Or, did this past year induce long-lasting changes in our behaviors – not just the social aspect, but also how we acquire a product or service? So many were hunkered down at home for over a year – working from home, eating at home, shopping from home and zooming way too much! I was digital-first for nearly everything! We’ve heard this story, but I am not sure we can imagine the lasting impact these changes will have on not only our day-to-day routines, but also on how we interact and shop for things like auto insurance. Although these new routines were assumed to be short-term, they have become ingrained for many. There are several studies that exist on the amount of time it takes to form a new habit. Whether you buy into the idea that it takes 21 days (study by Dr. Maltz) to form a new habit or an average of 66 days (study by Dr. Phillippa Lally), we are so far beyond both of those to that I have to believe many of the routines are now rote or ingrained.

What Did All These Habit Changes Lead To?

A major theme came out of the past year that is driving change across all industries but was amplified within the insurance/financial services industries, and that is the Rise of Digital.

Rise of Digital:

Although digital transformation has been in play for years, the pandemic hastened the adaptation and even acceptance of digital interactions for both providers and their customers. Having a holistic and seamless omnichannel experience has been a significant strategy for insurance providers for several years and of course digital plays a major role. A (consistent) digital presence is imperative to drive new business, customer engagement and even provide a way to explore operational efficiencies. The providers that had already made good progress along the digital evolution journey were able to pivot quickly, while those lagging behind were essentially forced to react overnight. I would like to explore and pose 3 questions that have arisen due to the rise of digital during the pandemic:

- Did the pandemic affect the insurance customer journey?

- What about personalization in a digital world?

- Is there an additional benefit of operational efficiencies from “forced” digital?

Did the Pandemic Alter the Customer Journey?

We knew customers typically started their journey online, but would they finish it there as well? In a recent Big Village CARAVAN poll, we asked 1,000 consumers about their journey or process of researching and purchasing auto insurance. We specifically concentrated on what they had acquired over the past year (during pandemic). Not surprisingly, the vast majority (81%) started with some sort of research online with a higher proportion of Gen Z & Millennials (90%) starting online. We found that a couple hundred of those surveyed purchased a new auto policy in 2020 and wanted to know how they finalized the deal – in-person, over the phone or online. Although most were still in-person or called, a good portion (43%) finalized the purchase online.

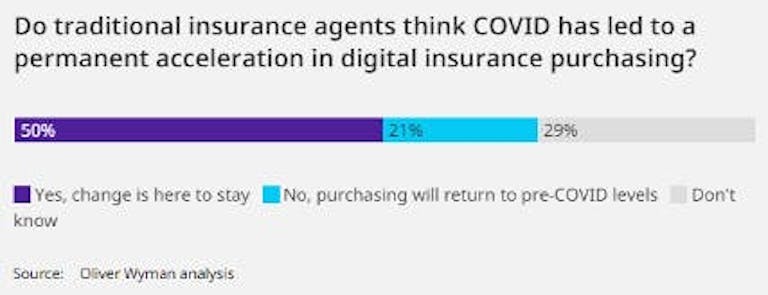

Both captive and independent insurance agents believe digital insurance purchasing is here to stay as well! Some even worry that these habits may be harmful for traditional agents.

With online insurance purchasing likely here to stay, providers need to use some caution when attempting to incorporate a digital heavy strategy – personalization is key!

How Has Personalization Been Affected?

It is imperative to understand that personalization can be lost in a digital world, but how can providers deliver personalization in a digital world? AI, machine learning and data sciences is a strong strategy, for starters. This combination can enable you to know who is contacting you and anticipate specific customer needs. Insurance providers should look to Insurtech companies to help them build a seamless and more holistic digital platform for communicating and servicing their customers. Combining a provider’s years of industry expertise with the tech prowess of an Insurtech can lead to insights that will make processes simpler, more efficient, and, most importantly, customer focused.

As providers and agents alike continue to incorporate these initiatives, it will be important to gather feedback along the journey to ensure digital is consistent with or even better than what they experienced in the past – either with a live agent or customer service rep.

Utilizing tools and techniques like AI, machine learning and data sciences will help reduce the need of repetitive processes – leading to operational efficiencies, customized plan options and ultimately a simpler customer journey from exploration to enrollment.

How Has the Pandemic Potentially Accelerated Efficiency Efforts?

At Big Village Insights, we partner with a top insurance provider on a CX program that involves interviewing thousands of customers each year. The research helps keep a pulse on customers, not only from a key performance indicator perspective, but also to explore operational aspects of the business. Specific touchpoints from on-boarding, billing and claims interactions are explored on a continuous basis. One of the major business objectives is to help the business be as operationally efficient as possible. This program helps find areas of improvement and potentially identify operational efficiencies that will reduce costs and create an enhanced customer experience.

Even though they are well into their digital journey, they still benefited from the quick and somewhat “forced” adoption of digital during the pandemic. One example is that they were able to equip agents and employees with the tech and training needed to service clients – moving from an in-person approach to digital world essentially overnight. We had already been seeing a steady increase (within our tracking data) of digital usage across customer touchpoints, but pandemic hastened that usage. Many of the touchpoints have shifted from “live” (in-person or over the phone interactions) to digital based, whether through a website, an app, or even a digital-based customer service rep. The ability to provide a strong path to purchase and customer service tool digitally will help insurance providers not only gain but retain customers with speed and efficiency. As time progresses more and more customers are going to feel comfortable on-boarding digitally. Although the human touch will continue to be important in this industry, the rise of digital and a provider’s ability to address this issue will either create a big opportunity for a provider or a big toll for those who do not address it properly.

Three Key Takeaways:

- Digital transformation was already a hot topic, but the pandemic hastened adoption and even acceptance, especially in the financial services space.

- Insurance providers must continue to develop digitally and personalize the experience.

- It is important to track performance and recognize potential operational efficiencies gained from digital transformation.

Written by Dave Stewart, VP at Big Village Insights.