In February 1973, The New York Times published some of the earliest media coverage on sustainable investing.

In an article entitled “Why ‘Good Guy’ Funds Have Flopped,” two mutual funds are profiled, the First Spectrum Fund and the Dreyfus Third Century Fund. The premise behind both funds was to only invest in socially responsible corporations, and The Times noted that both funds underperformed market averages by a wide margin.[i]

“In the early 1970s, sustainable investing was an idea that was ahead of its time,” says First Spectrum Fund co-founder Thomas Delaney. “Back then, the sole purpose of corporations was to make a profit, and their responsibility was to their shareholders – not society,” he notes.

Fast forward to today and that attitude has changed markedly. Investors have developed a voracious appetite for anything sustainable as it relates to finance, and the demand for sustainable investments have skyrocketed as a result.

The premise behind sustainable investing encompasses stocks, bonds, funds, and investments that look to generate market rate financial returns while also pursuing positive social, environmental, or good corporate governance returns. Environmental, social and governance (ESG) investing, socially responsible investing, impact investing, and ethical investing are similar terms that share the same goals as sustainable investing.

“Hockey Stick” Growth

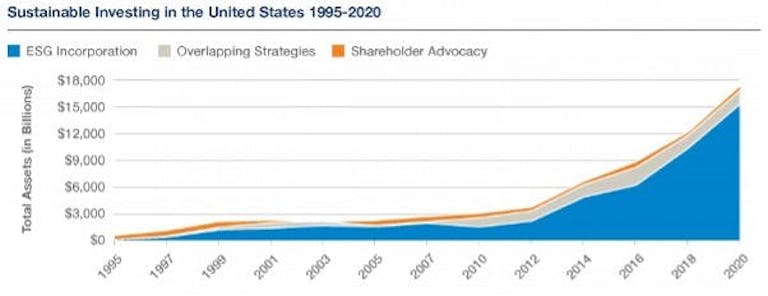

In the past few years, sustainable finance has exploded and shows no signs of slowing down. Figures from US SIF (The Forum for Sustainable and Responsible Investment) estimate there were over $17 trillion in assets under management using environmental, social and governance (ESG) strategies at the start of 2020, which is up from $12 trillion at the start of 2018 – a rise of 42%. US SIF reports that sustainable assets represented 33% of all professionally managed assets in the U.S. – or one out of every three dollars under professional management.[ii]

Source: US SIF: The Forum for Sustainable and Responsible Investment

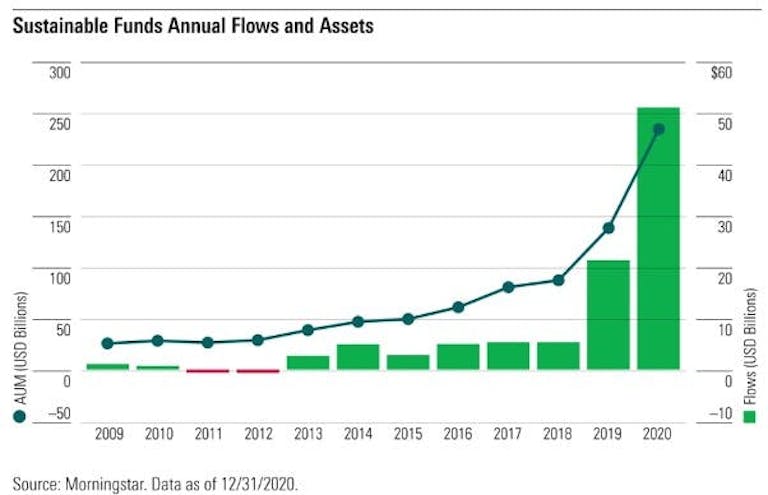

Mutual funds represent one of the easiest ways for investors to invest sustainably, and there were around 400 sustainable funds available to U.S. investors at the end of 2020, compared to just 139 in 2015. Not surprisingly, sustainable funds in the U.S. attracted record flows from investors over the past few years. In 2020, according to industry tracker Morningstar, flows into sustainable funds in the U.S. reached over $51 billion, or nearly 25% of newly invested money. This was a significant increase over 2019, when flows were $21.4 billion, which dwarfed the increase from 2018, when flows were $5.4 billion.[iii]

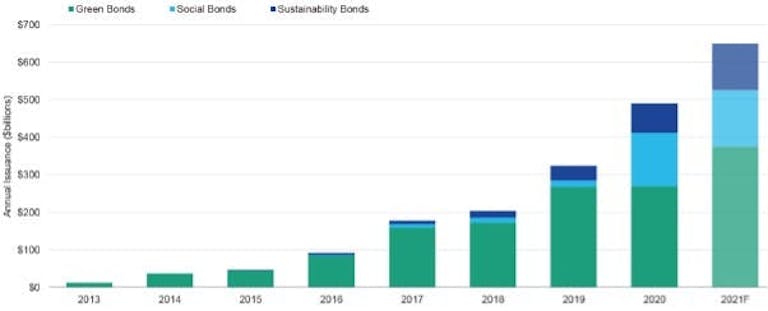

Governments, corporations, and other groups are rushing to the market to cash in on the sustainable finance phenomenon. According to Moody’s Investor Service, the collective issuance of green, social and sustainability bonds worldwide will reach a record of $650 billion in 2021, up 32% over the $491 billion issued in 2020. Moody’s says sustainable bonds may represent 8-10% of total global bond issuance in 2021, representing an appreciable increase over the 5.5% of total bond issuance sustainable bonds recorded in 2020.[iv]

Image Source: Environmental Finance

No matter who is measuring or what is being measured, the growth in sustainable finance resembles a hockey stick, where it is flat in the beginning and then rises steeply and dramatically, much like the handle of a hockey stick.

Growth Drivers for Sustainable Finance

Recently, a confluence of events has combined to drive the stratospheric growth in sustainable finance. The ongoing coronavirus pandemic, social inequality and injustice that was brought to the forefront by the Black Lives Matter movement, the negative effects of the climate crisis, and the election of Joe Biden and its presumed positive effect for a greener economy have all heightened the consciousness of sustainability in general, and have had a halo effect in finance.

Another reason for the explosive growth in sustainable finance is that study[v] after study[vi] has confirmed that sustainable investments perform as well, if not better, than conventional investments. This signifies that investors can align their investments with their values and still profit, which was not always the case.

Over the past few years, millennials have been the propellant that has fueled the surge in investor demand for ESG products, as millennials are twice as likely as overall investors to invest in companies targeting social or environmental goals. Morgan Stanley reports 95% of millennials were interested in sustainable investing in 2019, up 9 percentage points from 2017.[vii]

“Close to 60% of Millennials and half of Gen Z say it is important for them to know where a brand stands on social issues, and that goes for their investments, too,” says Michael Corti, VP at Cassandra, Big Village’s generational insight and cultural strategy group.

Corti adds that racism and environmental & climate change are the top two causes millennials and Gen Z think are most important to take a stand on, so it makes sense that they are investing in companies and funds that align with their values.

Additionally, it is estimated that Baby Boomers will transfer $68 trillion to younger generations over the next 25 years, and most of it will be inherited by millennials.[viii] This will likely further accelerate the transition to sustainable investments for years to come.

Written by John Delaney, Director at Big Village Insights.

[i] https://www.nytimes.com/1973/02/11/archives/why-good-guy-funds-have-flopped.html

[ii] https://www.ussif.org/Files/Trends/2020%20Trends%20Report%20Info%20Graphic%20-%20Overview.pdf

[iii] https://www.morningstar.com/articles/1019195/a-broken-record-flows-for-us-sustainable-funds-again-reach-new-heights

[iv] https://www.moodys.com/research/Moodys-Sustainable-bond-issuance-to-hit-a-record-650-billion–PBC_1263479

[v] https://www.environmentalleader.com/2021/02/research-finds-esg-activities-drive-better-financial-performance/

[vi] https://www.ft.com/content/733ee6ff-446e-4f8b-86b2-19ef42da3824

[vii] https://www.morganstanley.com/pub/content/dam/msdotcom/infographics/sustainable-investing/Sustainable_Signals_Individual_Investor_White_Paper_Final.pdf

[viii] https://www.euromoney.com/article/b1n0rl4jwqpvx8/generation-next-and-the-great-wealth-transfer